IVA Examples

Have a look at some of the IVA examples below. These examples represent possible IVA cases for people with a varied range of different circumstances, including income, expenses, debt level, living situation, marital status etc...

If you would like to know more about an IVA or if you are having difficulty with managing your debts, please do not hesitate to contact us. We can advise on all kinds of debt and if an IVA isn't your best option, we can help you find out your other options too.

All advice is free, private and confidential. Your information will never be passed to any third parties.

IVA Examples

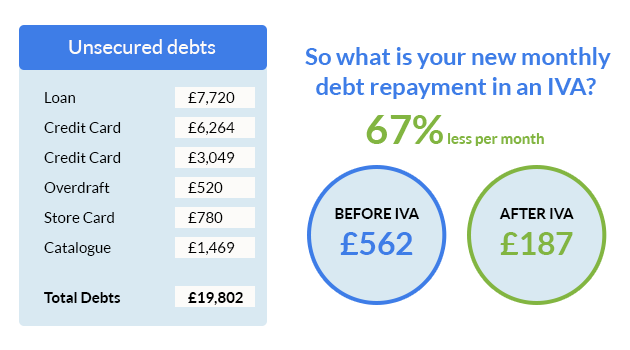

Client was struggling with monthly payments of £562 on debts totalling £19,802. We were able to get the payments reduced down to £187 with an IVA. They will pay this for 60 months. The total debt repaid will be £11,220. On completion of the IVA, the remaining £8,582 will be written off and they will be able to start over debt free.

Client was struggling with monthly payments of £708 on debts totalling £46,064. We were able to get the payments reduced down to £304 with an IVA. They will pay this for 60 months. The total debt repaid will be £18,240. On completion of the IVA, the remaining £27,824 will be written off and they will be able to start over debt free.

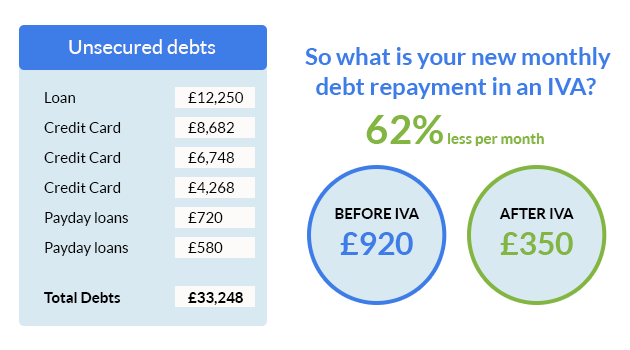

Client was struggling with monthly payments of £920 on debts totalling £33,248. We were able to get the payments reduced down to £350 per month with an IVA. They will pay this for 60 months. The total debt repaid will be £21,000. On completion of the IVA, the remaining £12,248 will be written off and they will be able to start over debt free.

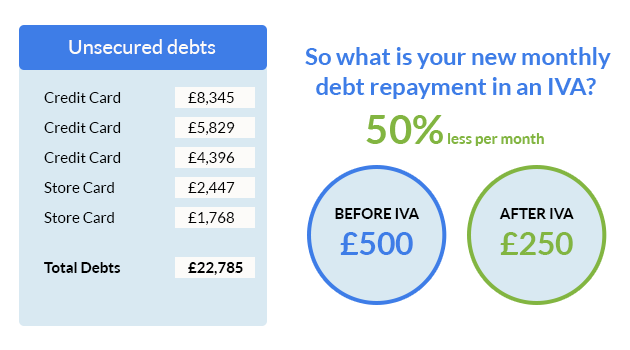

Client was struggling with monthly payments of £500 on debts totalling £22,785. We were able to get the payments reduced down to a more affordable payment of £250 per month with an IVA. They will pay this amount for 60 months. The total debt repaid will be £15,000. On completion of the IVA, the remaining £7,785 will be written off and they will be able to start over debt free.

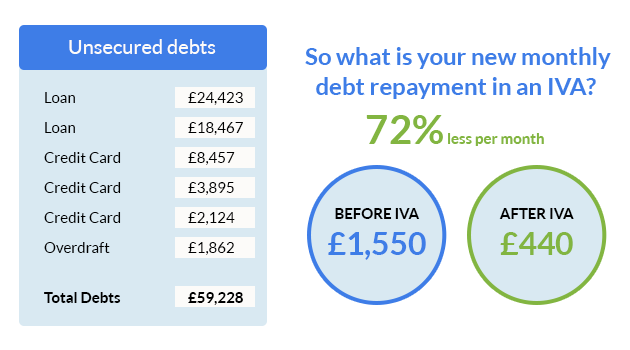

Client was struggling with monthly payments of £1,550 on loans and credit cards totalling £59,228. We were able to get the payments reduced down to a more affordable payment of £440 per month with an IVA. They will pay this amount for 60 months. The total debt repaid will be £26,400. On completion of the IVA, the remaining £32,828 will be written off and they will be able to start over debt free.

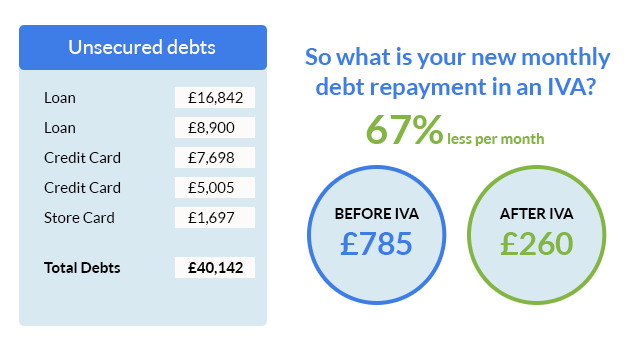

Client was struggling with monthly payments of £785 on loans and credit cards totalling £40,142. We were able to get the payments reduced down to a more affordable payment of £260 per month with an IVA. They will pay this amount for 60 months. The total debt repaid will be £15,600. On completion of the IVA, the remaining £24,542 will be written off and they will be able to start over debt free.

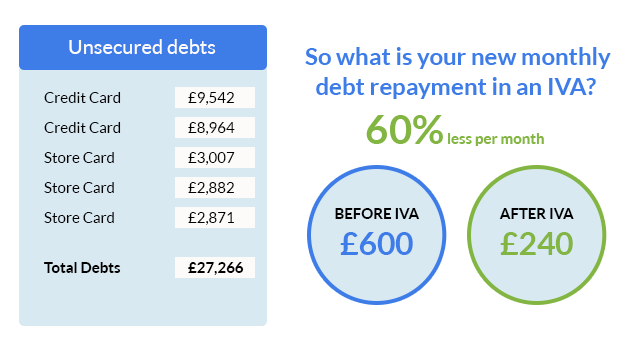

Client was struggling with monthly payments of £600 on loans and credit cards totalling £27,266. We were able to get the payments reduced down to a more affordable payment of £240 per month with an IVA. They will pay this amount for 60 months. The total debt repaid will be £14,400. On completion of the IVA, the remaining £12,866 will be written off and they will be able to start over debt free.

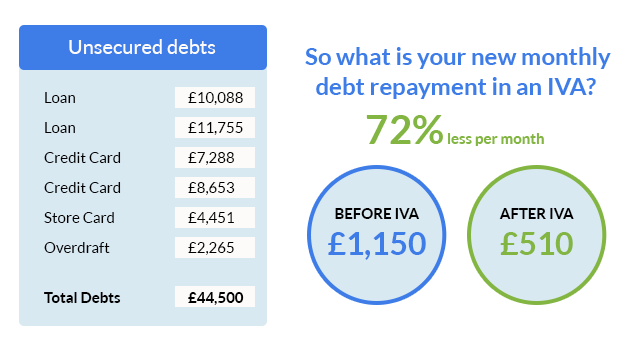

Client was struggling with monthly payments of £1,150 on loans and credit cards totalling £44,500. We were able to get the payments reduced down to a more affordable payment of £510 per month with an IVA. They will pay this amount for 60 months. The total debt repaid will be £30,600. On completion of the IVA, the remaining £13,900 will be written off and they will be able to start over debt free.

IVA Testimonials

We pride ourselves on good customer service. See what our clients have to say

IVA fees

Your creditors allow us to take fees from your IVA payment for managing your IVA.

Apply for an IVA

Get free IVA Advice now if you are struggling with debt. It is our job to help.