IVA NI - Information

You can get information on an Individual Voluntary Arrangement (IVA) by filling in this form. An advisor will call you to provide free and confidential advice. Alternatively you can browse the IVA options below and read some more about IVAs.

If you are having difficulty with debt please do not hesitate to contact us. We can advise on all kinds of debt and if an IVA isn't your best option, we can help you find out your other options too.

- First Class

I was in a mess with my debts, but the way they sorted out all my problems and made life less stressful was great. Service and speed in which they sorted my IVA was superb. Would recommend them to any friend.

Andrew on TrustPilot

IVA Testimonials

We pride ourselves on good customer service. See what our clients have to say

IVA fees

Your creditors allow us to take fees from your IVA payment for managing your IVA.

Apply for an IVA

Get free IVA Advice now if you are struggling with debt. It is our job to help.

An IVA (Individual Voluntary Arrangement) explained

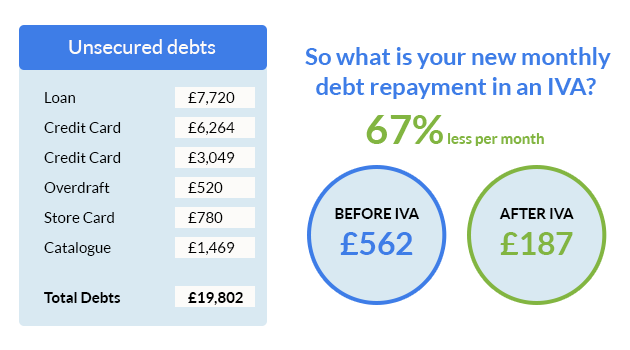

An IVA (Indivudal Voluntary Arrangement) is a formal agreement between you and your creditors (the people that you owe money too) where you agree to pay what you can afford towards your debts, by means of affordable monthly payments spread out over a period of (usually) 5 years (or in 1 lump sum).

An IVA could be suitable for you if you have unsecured debts above £10,000 and you are struggling to make repayments, you owe money to atleast 2 or more creditors and you have some sort of disposable income left over each month after all living expenses have been accounted for (not including any debt repayments). An IVA is suitable for individuals, couples, business owners, homeowners, tenants etc...

On completion of the IVA, your creditors agree to write off any remaining debt, allowing you a fresh start free from debt. Because an IVA is a formal agreement you will no longer be contacted or harassed by your creditors when it is in place.

When your IVA agreement is in place all charges and interest on your debts will be frozen. When you have completed the IVA, your monthly payments will stop and any remaining debt is written off leaving you debt free. See an example of how an IVA works below.

Setting up an IVA

1) DETERMINING YOUR IVA PAYMENT

When you first contact one of our advisors, they will run through a brief phone assessment to see what options are available to you. We need to let you know of all of your options as there could be more than one way to deal with your debts. If an IVA is your best recommendation and you want to proceed with it we will work out what you can afford for your monthly IVA payment.

Each IVA payment for an individual is different, because it is worked out by analysing your living situation, employment status, income, expenditure, amount of unsecured debts, number of creditors etc... When your IVA payment has been worked out, we can then draft your proposal for your creditors.

2) DRAFTING YOUR PROPOSAL

In order to set up an IVA an Insolvency Practitioner (IP) is required. This is the licensed individual who is qualified to set up your IVA proposal and negotiate the IVA terms with the creditors. IVA Northern Ireland has 5 in-house Insolvency Practitioners so it means we handle all of our IVAs in-house too. Once your IVA proposal is drafted, it goes to a meeting of creditors, so your creditors can vote on it.

3) MEETING OF CREDITORS

At the meeting of creditors, your creditors to decide if they want to agree to the IVA proposal. If 75% of your creditors, by debt value, agree to the proposal, then the IVA can begin and you can start making your payments.

Apply for an IVA

If you would like to know more about an IVA or think you would like to apply for more information, click on the button below and fill out the form on this page. Or give us a call on 0800 043 3328. An advisor will get in touch with you to to discuss your options. All advice is private and confidential and your details are not passed to any third parties.

Pros of an IVA

1 easily affordable monthly payment.

Unlike some of our competitors we do not charge any upfront fees, saving you time and money.

An IVA offers you protection from your creditors.

Creditor pressure is stopped as your creditors must deal with us when in an IVA.

An IVA can be complete in as little as 1 year if you can offer a lump sum payment.

All interest and charges on your debt are frozen immediately.

An IVA is suitable for tenants or homeowners, individuals or couples and even businesses/self employed people.

We can set up an IVA in as little as 4 weeks.

Cons of an IVA

If you are a homeowner with equity in your property you may be required to introduce part of your share of this equity in the final year of the arrangement. A remortgage may be restricted and on less favourable terms and if you can’t get a remortgage your arrangement could be extended.

If your circumstances change, and your IP can’t get creditors to accept amended terms, the IVA is likely to fail. You will still owe your creditors the full amount of what you owed them at the start, less whatever has been paid to them under your IVA.

If your IVA fails, your creditors may request that you be made bankrupt. This will always be discussed before your arrangement commences.

Your credit rating may be impacted for up to six years from the commencement of your IVA.

NOTE: In an IVA you will have an agreed budget for your living costs. There are allowances for this in the agreement. These expenses will be mostly based on what you currently have to pay out each month. You should declare all normal monthly expenses to your creditors so they understand your situation more clearly. There may be some restrictions on some expenditure items, such as mobile phone bill for example.